- Backoffice Weekly by Faliam

- Posts

- April 4, 2025 Newsletter

April 4, 2025 Newsletter

Welcome to Backoffice Weekly by Faliam

04/04/2025

This is the third edition of Backoffice Weekly, where we aim to bring you the most important dental news related to finance, technology, and AI to help you enhance your back office.

1. Senate Passes Amended Budget Resolution with Healthcare Implications

Summary

The Senate voted 52-48 on April 3 to pass an amended budget resolution for fiscal 2025, maintaining provisions that could significantly impact healthcare funding—particularly the directive for the House Energy and Commerce Committee to identify $880 billion in spending cuts that could affect Medicaid.

Details

Healthcare leaders are intensifying advocacy efforts against potential Medicaid cuts, warning of threats to care access and hospital stability, particularly in safety-net and rural communities.

Scripps Health CFO Brett Tande noted that Senate Republicans broadly support Medicaid work requirements, which could save approximately $130 billion over 10 years.

Deeper Dive [7 min]

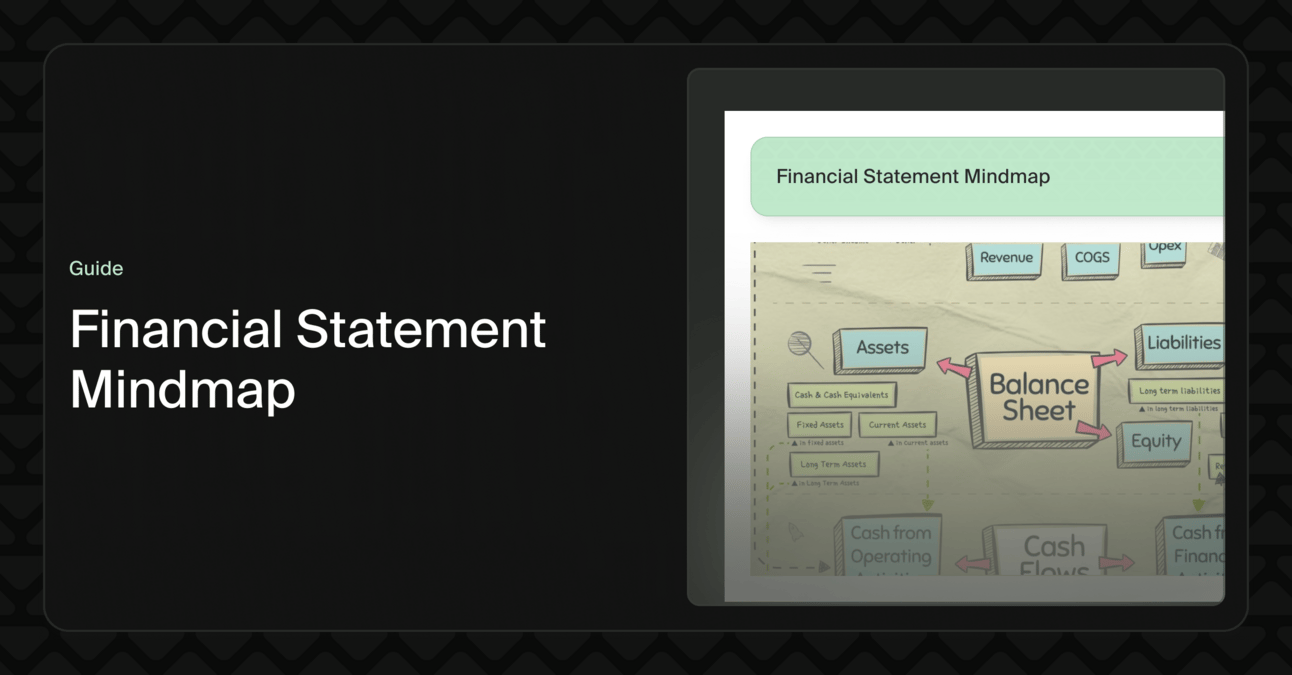

2. Josh’s Financial Statement Mindmap

Summary

Josh’s comprehensive visual breakdown explains the connectivity of the three primary financial statements—Profit & Loss, Balance Sheet, and Statement of Cash Flows— with each serving distinct purposes in financial reporting. You can download below

Details

The Profit & Loss (P&L) statement tracks income (revenue and other income) against expenses (COGS, operating expenses, and other expenses) to calculate net income.

The Balance Sheet presents a cumulative financial position through assets, liabilities, and owner's equity, pulling net income data from the P&L via retained earnings.

The Statement of Cash Flows organizes cash movement by operating, investing, and financing activities, drawing data from both other statements.

Deeper Dive [2 min]

3. Ken Kaufman’s Single Financial Metric [LinkedIn]

Summary

Ken Kaufman highlights that Free Cash Flow (FCF) should be the primary financial metric for dental groups. Easy to trick yourself with metrics; ultimately, the cash you have to grow your business is what matters.

Details

FCF is calculated as Cash from Operations minus Cash from Investing Activities, which is found on the Cash Flows Statement.

Positive FCF indicates your practice is creating value, while negative FCF suggests it's burning cash.

Strong FCF enables practices to invest in growth, pay down debt, distribute profits, and weather downturns.

Deeper Dive [2 min]

Thank you for your time!

Faliam Team!