- Backoffice Weekly by Faliam

- Posts

- Predicting Cash Flow, Rise of COFO, and Dashboards

Predicting Cash Flow, Rise of COFO, and Dashboards

This is the fourth edition of Backoffice Weekly, where we aim to bring you the most important dental news related to finance, technology, and AI to help you enhance your back office.

💡 Predicting Cash Flow When Revenue Swings Like a Pendulum

On-demand pricing has emerged as a powerful growth lever for dental practices—aligning fees directly to utilization and keeping patients happy. But that same flexibility can wreak havoc on cash-flow forecasting: one slow week or unexpected surge in usage and your projections shift overnight. Variable, user-based fees turn steady revenue streams into roller-coaster rides, forcing finance teams into reactive fire drills instead of proactive planning. The antidote? Close collaboration between clinical, operations, and finance—backed by real-time analytics, dynamic forecasting models, and a disciplined collections process—to turn unpredictable cash leaks into controlled, sustainable growth. 🌱

Key Takeaway:

On-demand models make cash flow forecasting tough due to pricing variability.

The practice and Finance teams must work together to track patient behavior and payment patterns.

Reducing uncertainty is key to revenue optimization and happier customers.

For dental CFOs, regular review and a healthy relationship with your collections process will turn cash leaks into controlled irrigation for growth. 🌱

💼 The Rise of the COFO: When Your CFO Role Grows Muscles

This week, Salesforce formally unveiled the COFO — Chief Operating & Financial Officer — signaling how automation and modern ERPs are dissolving the line between finance and operations. For dental groups and DSOs, a COFO can fuse forecasting, supply-chain oversight, staffing, and clinic logistics under one hybrid leader, driving faster, more cohesive decision-making. Yet broadening the CFO mandate to include process design and people management demands robust data platforms, dynamic reporting, and cross-team collaboration to avoid scope creep.

Key Takeaway:

If your CFO also owns supply-chain and staffing, how would that reshape budgeting cycles and vendor negotiations?

Can a finance leader maintain deep P&L rigor while driving day-to-day clinic operations and team dynamics?

Data demands: What real-time dashboards and cross-team metrics would a COFO need to make decisions on the fly?

🦷 Dental Dashboards: Pitfalls and Payoffs

Data is the lifeblood of modern dental practices—but getting clean, timely inputs (think: timesheets, billing codes) feels impossible. Building dashboards that surface true performance (not just coffee-refill counts) is an art: do it poorly, and you’re flying blind; do it right, and you catch issues before they spiral. Start with core financials (P&L, balance sheet), lean on tools like Power Query for data cleaning, define clear KPIs with period filters—and watch quarter-end surprises fade away.

Details

Start simple: Import core financials (P&L, balance sheet), then build.

Invest in data cleaning tools; Power Query is a game-changer.

Define KPIs and make sure you can filter by time periods for easy period-on-period review.

Good dashboards mean fewer nasty surprises come quarter-end.

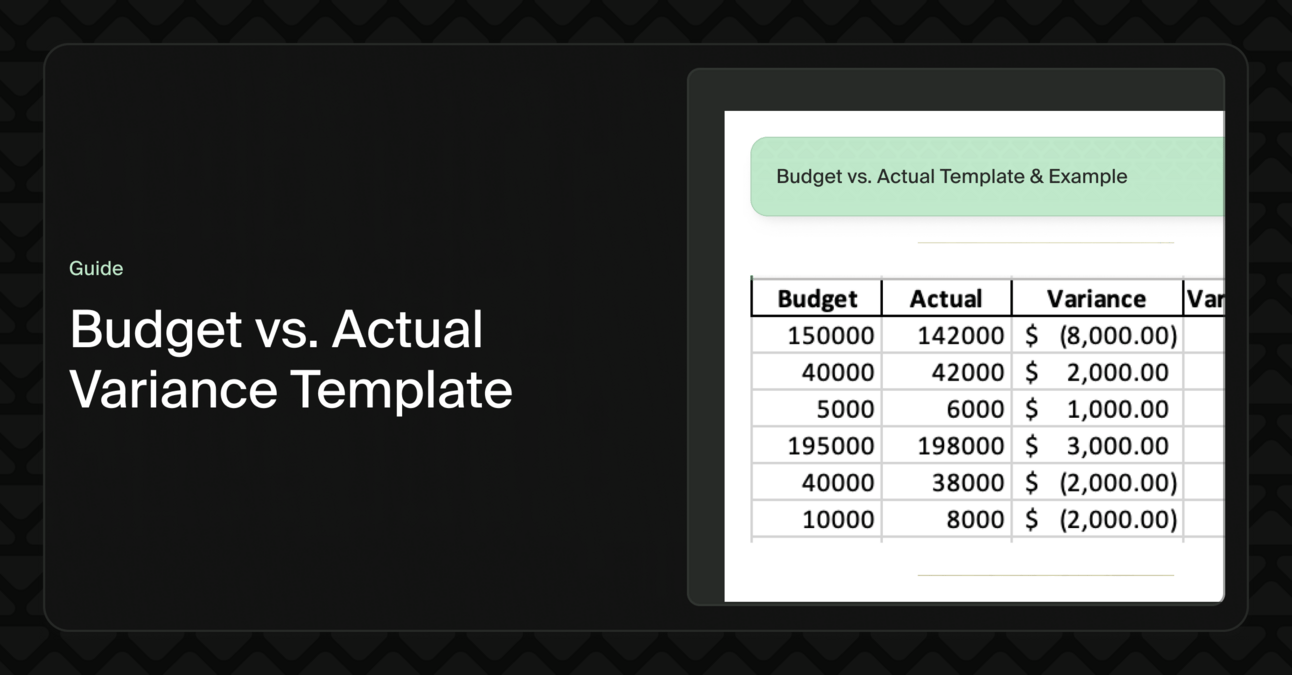

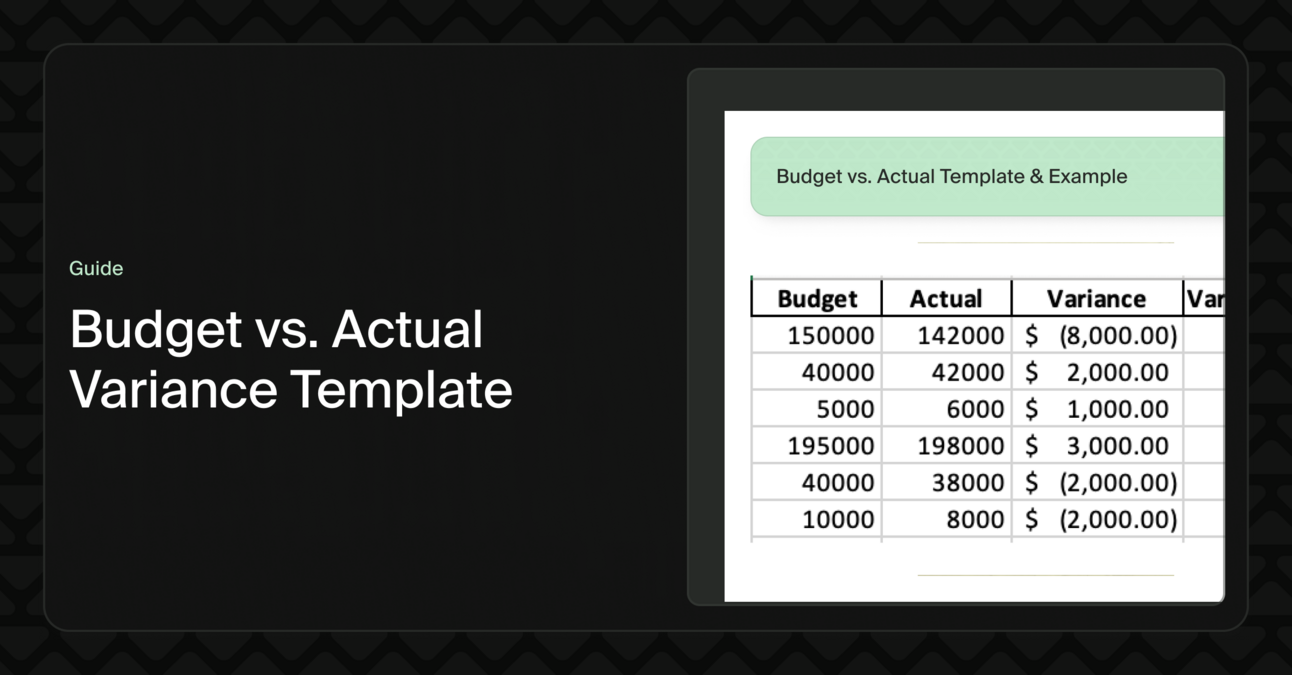

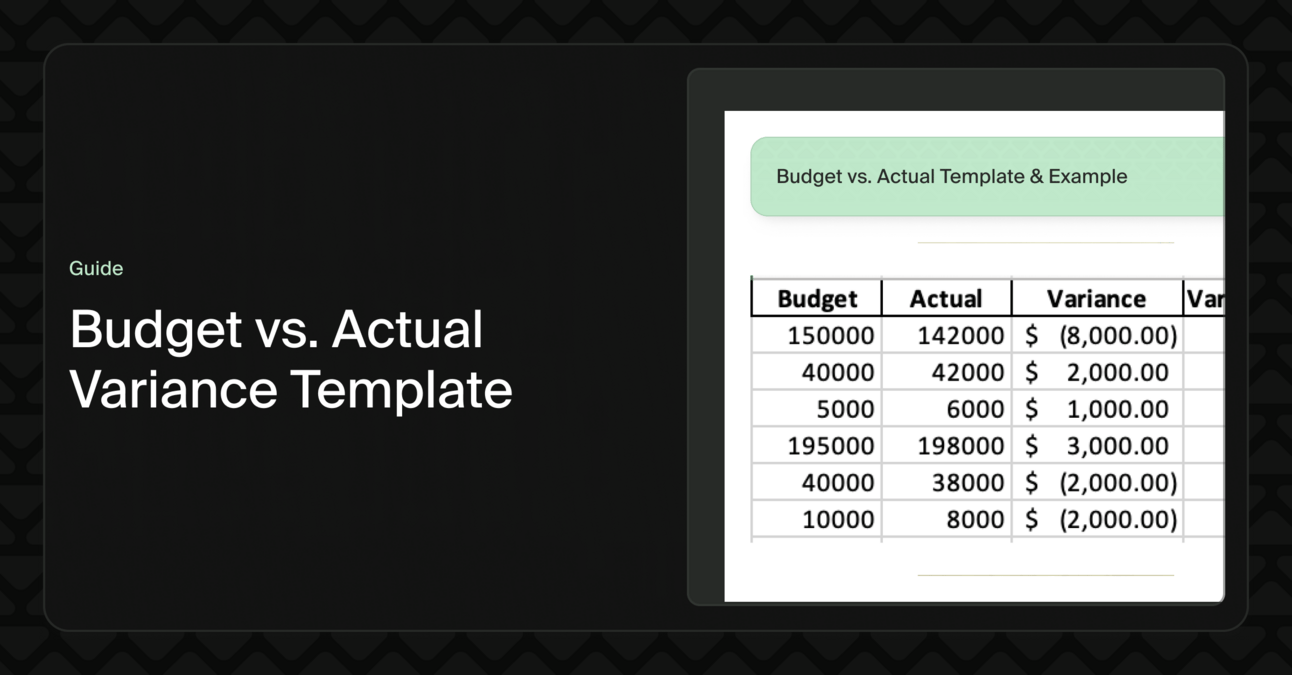

Toolbox

|

Email me [email protected] for the excel sheet of the template.

Thank you for your time!

Best,

- Faliam team